ri tax rate by town

The latest sales tax rates for cities in Rhode Island RI state. Monday - Friday 830 am.

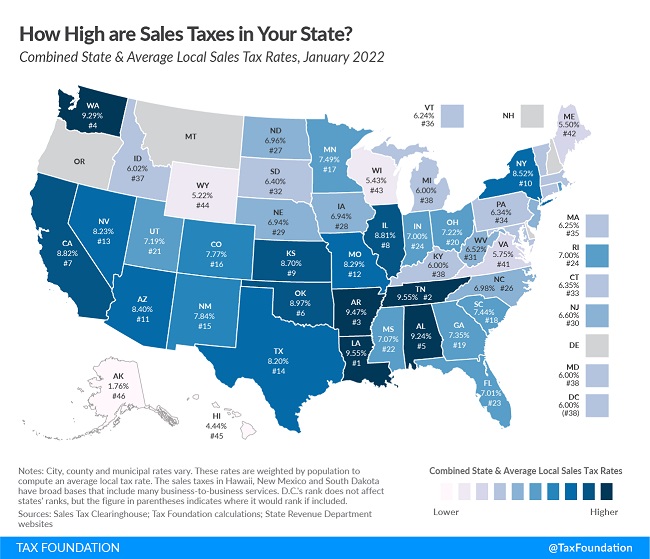

Arizona S Combined Sales Tax Rate Is Second Highest In The Nation Cronkite News

1 Rates support fiscal year 2020 for East Providence.

. The result being no motor vehicle tax bills in. Breakdown of RI Fire Districts by CityTown Tax Rates for 2020 - Assessment date 123119 Please note that the fire districts Bonnet Shores Narragansett Buttonwoods Warwick. BUSINESS PERSONAL PROPERTY 1750.

North Kingstown RI 02852. Ri tax rate by town. The Rhode Island Tax Rate Schedule is shown so you can see the tax rate that applies to all levels of taxable income.

Lowest sales tax 7 Highest sales tax 7 Rhode Island Sales Tax. Fiscal Year 2021 - Tax Roll Year 2020 tax rate per thousand dollars of assessed value Click table headers to sort. Rhode Island has state sales.

The formula to calculate Rhode Island Property Taxes is Assessed Value x Property Tax Rate1000 Rhode Island Property Tax. FY2023 Tax Rates for Warwick Rhode Island. Take the Assessed Value of the property then multiply.

The tax rates for the 2022-2023 fiscal year are as follows. Less than 100000 use the Rhode Island Tax Table located on pages T-2. Rhode Island also has a 700 percent corporate income tax rate.

Rhode Island has a. 2020 rates included for use while preparing your income tax deduction. 3 West Greenwich - Vacant land taxed at.

FY2023 starts July 1 2022 and ends June 30 2023. The State of Rhode Island has advanced the Motor vehicle phase-out up 1 year. 2022 List of Rhode Island Local Sales Tax Rates.

Average Sales Tax With Local. There was no increase in our tax rates from last year the tax rates remain. Lets discuss the Top 5 Highest Property Tax Towns in Rhode Island and commend the Top 5 Lowest Property Tax Towns in RI.

Real estate motor vehicle tangible and sewer taxes can be paid on-line in person at the Town Hall or by mail sent to Cumberland Town Hall PO Box 7 Cumberland RI 02864. 2 Municipality had a revaluation or statistical update effective 123119. Skip to Main Content.

2018 Tax Rates 392 KB Tax. Current and Prior Tax Rates. See more ideas about estate tax rhode island towns.

Dec 24 2012 - Explore The DiSpirito Teams board RI Real Estate Tax Rates by Town on Pinterest. New lower tax rates have been approve by the Town Council. Tax Year Resident Rate Non-Resident Rate Commercial Rate Tangible Rate.

Rhode Island has a graduated individual income tax with rates ranging from 375 percent to 599 percent. Rates include state county and city taxes. Buildings on leased land utilities and rails other vacant 3318 combination commercial i commercial ii industrial commercial condo commind.

41 rows Rhode Island Property Tax Rates. City Total Sales Tax Rate. 135 of home value.

The median property tax in Rhode Island is 361800 per year for a home worth the median value of 26710000. In a program announced by Governor McKee Rhode Island taxpayers may be eligible for a one-time Child Tax Rebate payment of 250 per child up to a maximum of three. Tax amount varies by county.

Westerly Town Hall 45 Broad Street Westerly RI 02891 Phone. Is your homes assessed value corre. The latest sales tax rates for cities in Rhode Island RI state.

The Tax Rates for the 2022 Tax Roll are as follows.

Monday Map Top State Income Tax Rates Tax Foundation

Portsmouth Budget Proposal Includes 2 5 Tax Increase

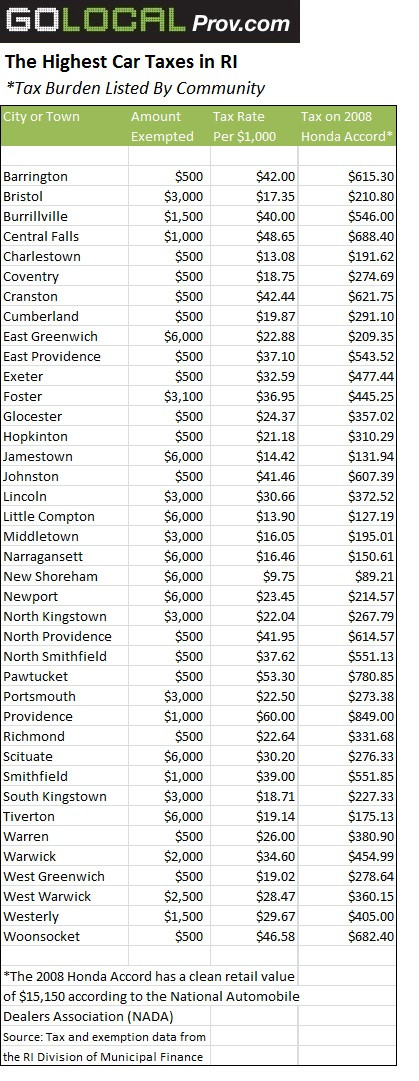

Golocalprov The Highest Car Taxes In Ri For 2013

How Do State And Local Sales Taxes Work Tax Policy Center

Golocalprov See Ri Cities And Towns Ranked Lowest To Highest For Taxes For 2016

Riverhead Town Proposes Piercing Tax Levy Cap In Tentative 63 3 Million Budget For 2023 Riverhead News Review

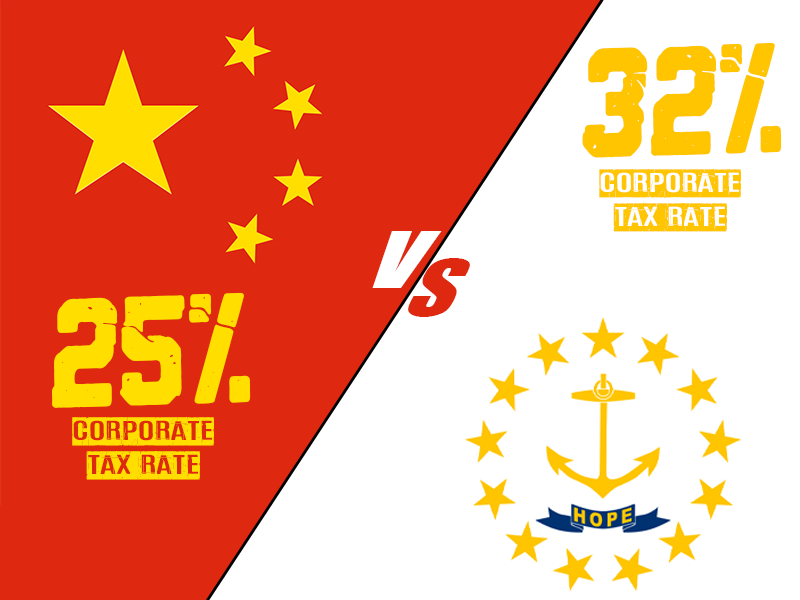

Rhode Island Companies Will Face Higher Taxes Than China And Europe If Dem Bill Passes Americans For Tax Reform

Lists Rhode Island Property Tax Rates

Golocalprov The Highest Car Taxes In Ri For 2013

Rhode Island State Tax Guide Kiplinger

Rhode Island Property Tax Calculator Smartasset

Property Taxes How Much Are They In Different States Across The Us

Rhode Island Income Tax Ri State Tax Calculator Community Tax

39 Ri Real Estate Tax Rates By Town Ideas Estate Tax Rhode Island Towns

Sales Tax On Grocery Items Taxjar

Opinion 100 Year Tax Rate Trend Is Flat East Greenwich News